Businesses are walking a tightrope between addressing compliance needs and creating seamless user experiences (UX). The rate of identity fraud online increased 41% in 2020 compared with previous years. At the same time, end-user expectations online are more strict than they’ve ever been — up to 43% of end-users will abandon signing up to online services if their expectations are not met. First impressions count.

But ask any organization today, and you’ll find a struggle between Product teams — who prioritize reducing clicks and complexity to improve conversion — and the Compliance and Risk teams who are focussed on putting in the necessary checks and balances. When teams fail to strike the right balance, they risk losing end-users to high-friction compliance processes, or simply take on too much risk.

At Onfido, we see compliance and UX as two sides of the same coin. We’ve built Onfido Studio to make this balance simple, giving businesses the tools they need to build tailored identity verification processes—orchestrating our suite of verifications with powerful, flexible, no-code workflows. Here are three tips for getting your compliance and UX balance right, and how you can make this a reality with Onfido Studio.

Acquisition without compromising on compliance with tailored workflows

No two end-users are the same, so why should their experiences be identical? Give them a seamless UX, and step up to additional compliance checks only when necessary.

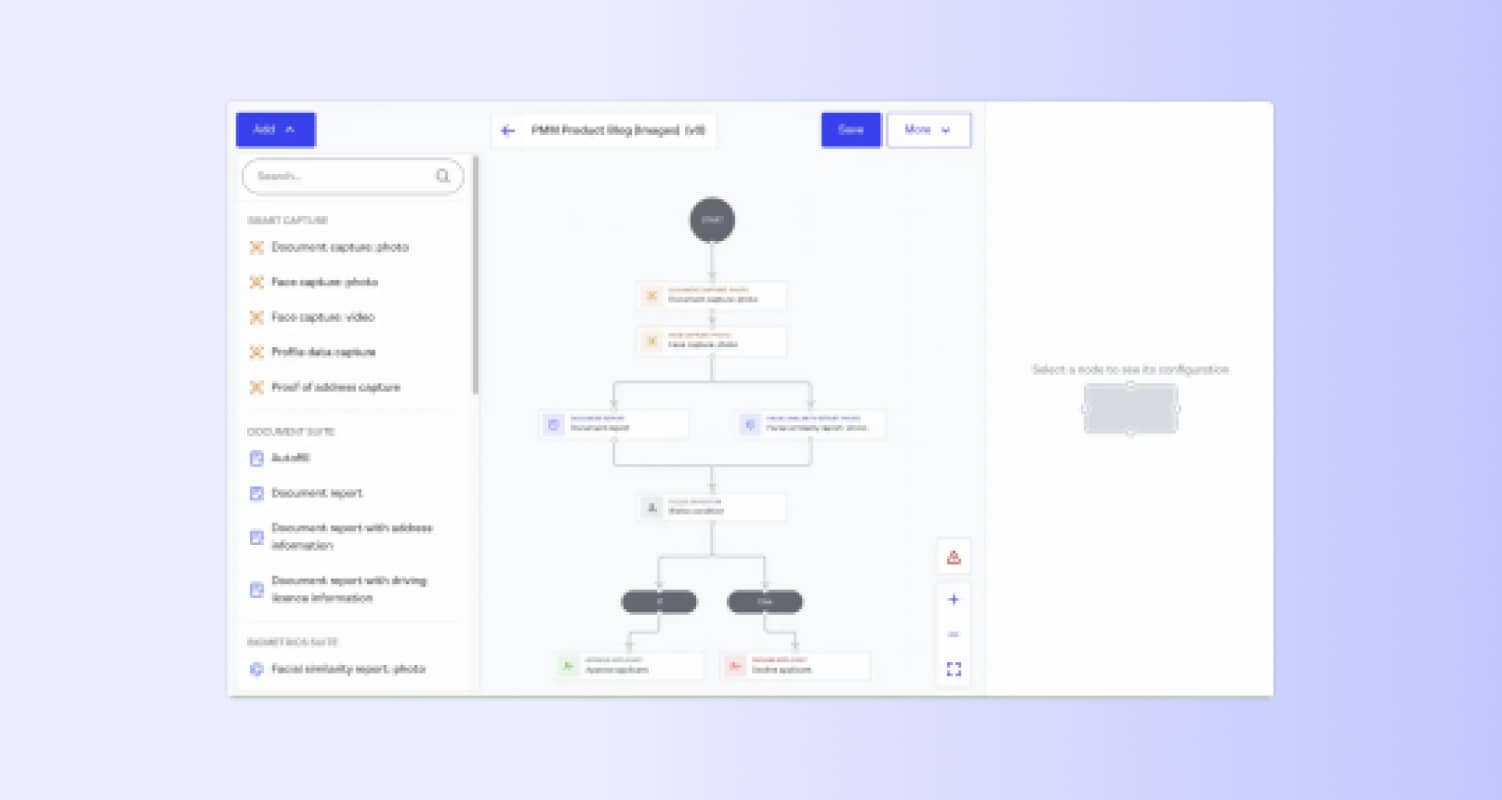

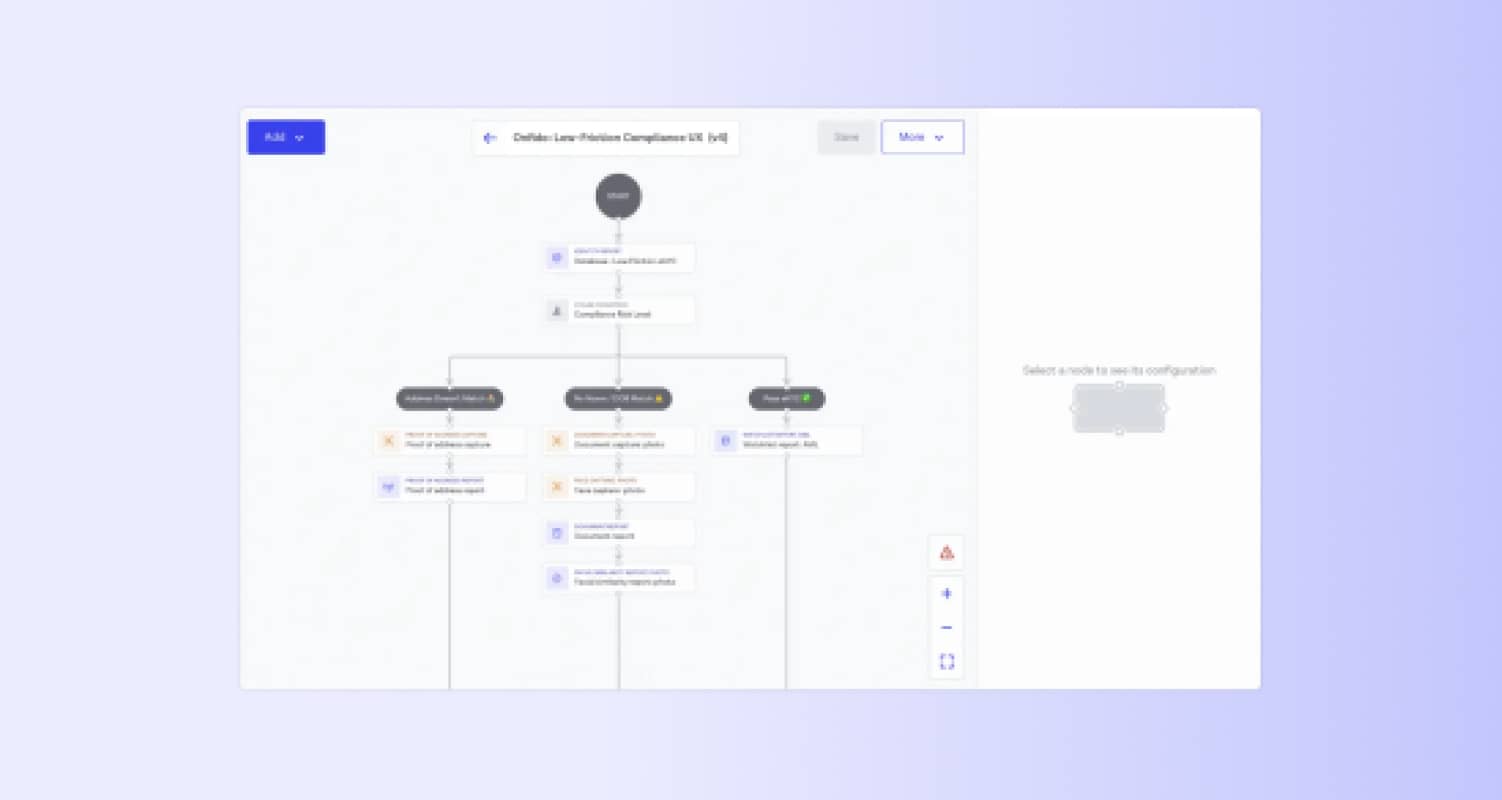

Striking a balance between compliance and UX starts with understanding which end-users your business is comfortable funneling through low-friction ‘happy paths’, and which require additional assessment. Let’s look at an example of a digital-first remittance provider looking to improve their onboarding. As part of their Know Your Customer (KYC)/ Anti-Money Laundering (AML) processes, they funnel end-users through an eKYC identity record check—this gives the business confidence in quickly onboarding those end-users for low-volume transactions. If everything is cleared, this is the end-user happy path. But for end-users who present higher risk — for example, their address doesn’t match against a database, or they are looking to spend above a specific transaction threshold — the remittance provider might ask for proof of address (POA), or identity document and biometrics.

In this scenario, if each end-user had to go through the additional verification steps, conversion rates would decrease. Likewise, if the bank removed the POA step for higher-risk end-users, they would not be fulfilling their compliance requirements. The first step to balancing the two is to define your business’ compliance requirements, and map out a happy path for low-risk scenarios. This gives both Product and Compliance teams a shared view of the user journey, so that the verification process can be assessed more clearly. Onfido Studio helps your business visualize this, mapping out low-friction and higher friction verification journeys, turning them into a reality with our no-code workflow builder.

Automate internal processes to keep your growth engine running smoothly

You’ve defined your compliance policies. You’ve spent months coding them into a reality. But somewhere during the onboarding process, an end-user gets caught in a review cycle that isn’t automated. Manual analysts scramble to review this before the end-user goes elsewhere. As your business grows, or experiences a sudden increase in applications due to seasonal events, this one user can turn into thousands.

Sound familiar? Manual bottlenecks stretch your team and turn genuine end-users away. Once you’ve defined your verification policies, identify what can be automated and build this into your product — freeing up your Operations teams to focus on end-users that really need help.

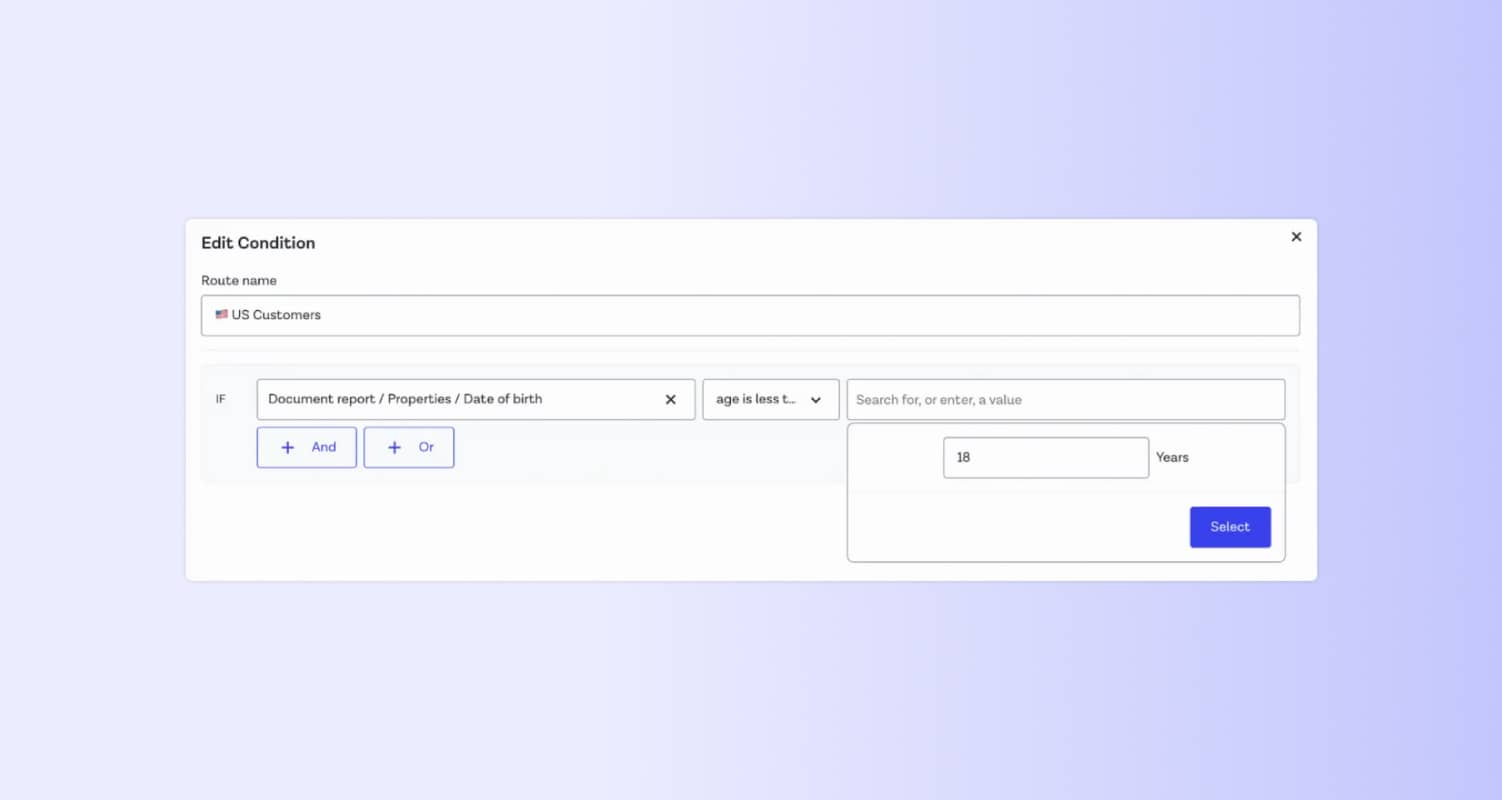

Imagine an iGaming business in the US. They don’t want to onboard anyone under the age of 21. Instead of requiring analysts to review each end-user, they can build rules to automate this check with Onfido Studio — simply build a condition to extract the date of birth on the document, and automatically reject anyone under the age of 21. With Studio, businesses can automate rules across our suite of verifications, increasing efficiency and reducing acquisition costs.

Scale quickly when new market opportunities and regulations arise

When new regulations or market opportunities arise, this should be an exciting opportunity. Inflexible verification processes can instead turn these opportunities into a pain, preventing new market growth and exposing your business to additional compliance risk.

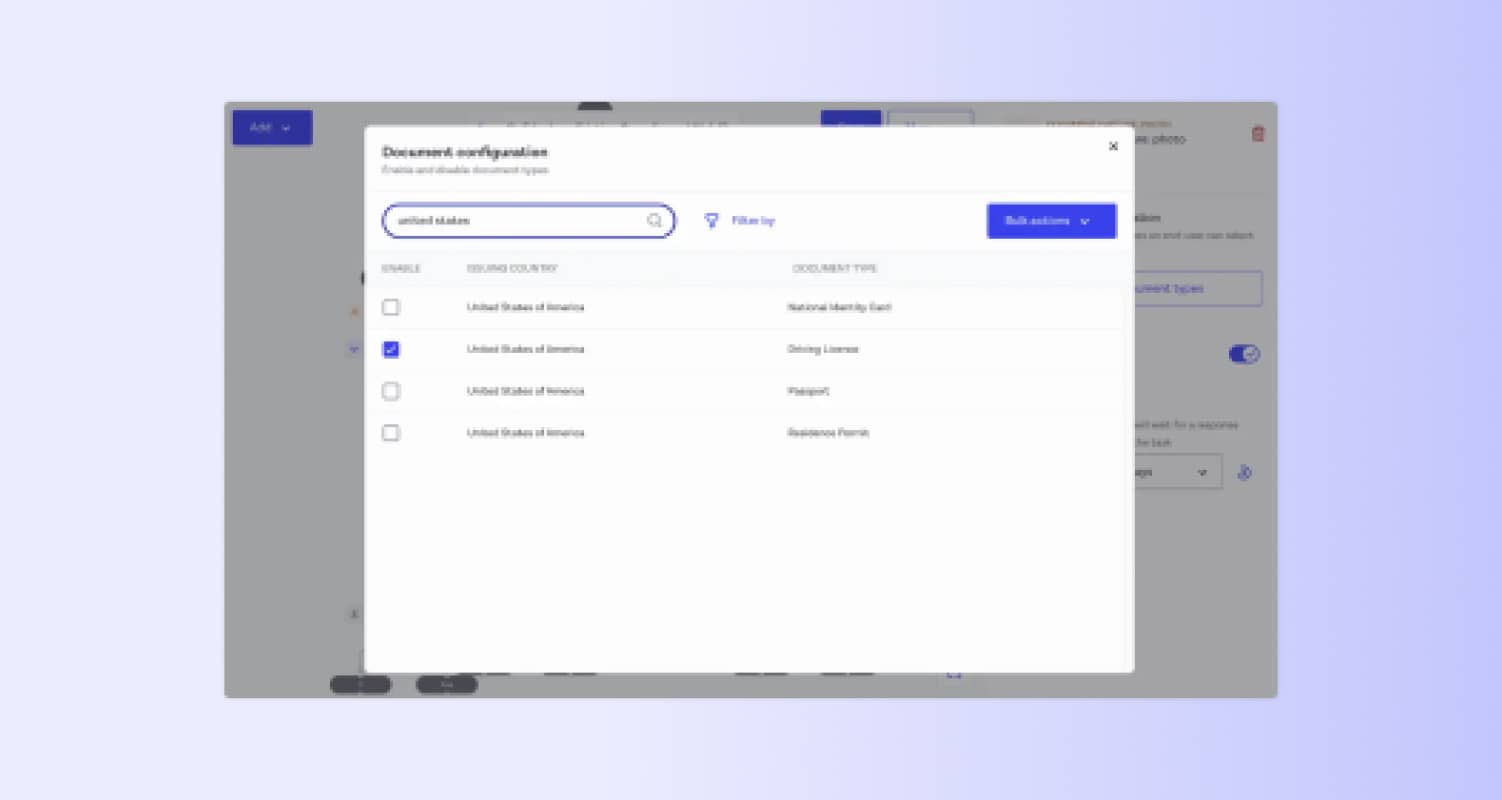

Onfido Studio means scaling to new opportunities is only a drag-and-drop away, moving as fast as your business. What if the remittance provider from earlier expanded to the US? In this case, the business might want a more bespoke, high-assurance signal to give their compliance teams more confidence. Equally, they don’t want to funnel every end-user through this new journey. So for end-users with a US driver’s license, the team creates a new workflow in Studio—requiring US end-users to upload a driver’s license so that the business can run a look-up against the Driver's License Data Verification (DLDV) database. With just a few clicks, the team has built a new experience only for the US without compromising on compliance.

Find your ideal balance, and make it a reality with Onfido

Wondering how you can improve your team’s balance between fraud and UX? Start by asking the following questions of your Product and Fraud teams:

-

What is the level of compliance risk my company is willing to tolerate?

-

What is the ideal path an end-user should go on? Where does drop-off occur?

-

Where are manual reviews currently causing disruptive bottlenecks?

Interested in learning more about how Onfido Studio can help make this balance a reality?