Despite the serious risk that fraud presents, many financial institutions don't have effective systems in place to deal with it. No approach is 100% foolproof. But building a fraud prevention strategy around five key considerations can help combat many of the risks.

Fraud is growing in quantity and quality

Customers across financial industries are now using services almost entirely online. Even as we start to return to normal after the pandemic, that’s unlikely to change.

But an uptick in digital processes and our increasing online presence means an increase in fraud. It’s a fact. Our research shows that the rate of identity fraud increased 41% over the previous year.

More online transactions, payments and personal banking opens up opportunities for fraudsters. This only makes risk and fraud management harder for banks and other financial institutions.

And fraud isn’t just growing. It’s evolving.

Businesses have to deal with a range of different types of attacks. From account takeover, to synthetic identity fraud, from replay attacks to advanced biometric fraud. Fraudsters continue to reinvent their approach.

To stop that threat, businesses need to do the same. But are they doing enough to keep up?

Fraud costs - but do we really know how much?

Estimates suggest that global losses from payment fraud alone were $32.39 billion in 2020. This is triple what it was in 2011.

Among other findings, surveys highlight that organizations are losing up to 7% of their annual turnover as a result of fraud. And yet only a small percentage of these losses are ever recovered.

It’s important to point out that most of these figures are estimates. Conservative ones at that. While there are a large number of surveys that seek to estimate the true scale and cost of fraud to businesses and society, it’s difficult to unearth the full picture.

Plus, these surveys often don’t take into account the associated costs of fraud. That includes the hours banking staff spent rectifying issues, the reputational damage to businesses, as well as personal costs that fraud has on victims.

But what is clear, is that fraud remains a serious and costly problem.

Take a proactive, not a reactive approach to fraud

So to counter the cost of fraud (and to combat new and growing threats) businesses need to invest time, money and resources into fraud risk management. A successful model provides a comprehensive approach to identifying, assessing, mitigating and monitoring fraud.

According to the Association of Certified Fraud Examiners (ACFE), the best approach to fraud risk management is proactive rather than reactive.

In other words, it’s no use waiting for problems to arise before fixing them. Organizations must take a risk-based approach to fraud, identifying how they might be attacked, and measuring that against their risk appetite.

From there, it's about putting robust fraud detection and prevention frameworks in place from the get-go, and analyzing developing fraud trends to stay ahead of emerging fraud trends and techniques.

5 considerations for effective fraud prevention strategies

That’s all very well, But in today’s digital banking environment, you need more than a strong team of fraud fighters. So what do you need for an effective fraud prevention strategy?

Businesses should consider the following:

-

People, strategy and governance: Fraud risk managers should educate on and enforce fraud strategy. Position from the top influences fraud prevention and detection strategies throughout the business. A successful model also needs the correct culture and individuals. Senior managers should employ the best team possible to tackle all different aspects of financial fraud. That team should have a diverse range of experience and be forensic and fraud-aware, but should include someone with a customer-centric mindset. The absence of any customer-centricity is often where teams fall down.

-

Balance: The best fraud set-ups don't exist in a vacuum. Fraud teams should work with customer experience and growth-focused parts of the business to achieve a balance between how much risk they take on and how many customers they onboard. Businesses could stop 100% of fraud overnight by not letting any more customers in. But the best fraud strategy understands that a balance is needed, and the team works with the broader business to get that balance right.

-

Assessment: What fraud risks is your businesses encountering, how have they changed? If fraud happens, what’s the potential cost to your business? The foundation for the prevention and detection of fraud starts with risk assessment. And to understand the risks, you need a firm grasp of the fraud landscape. For insights into the latest fraud trends and techniques, take a look at our Identity Fraud Report.

-

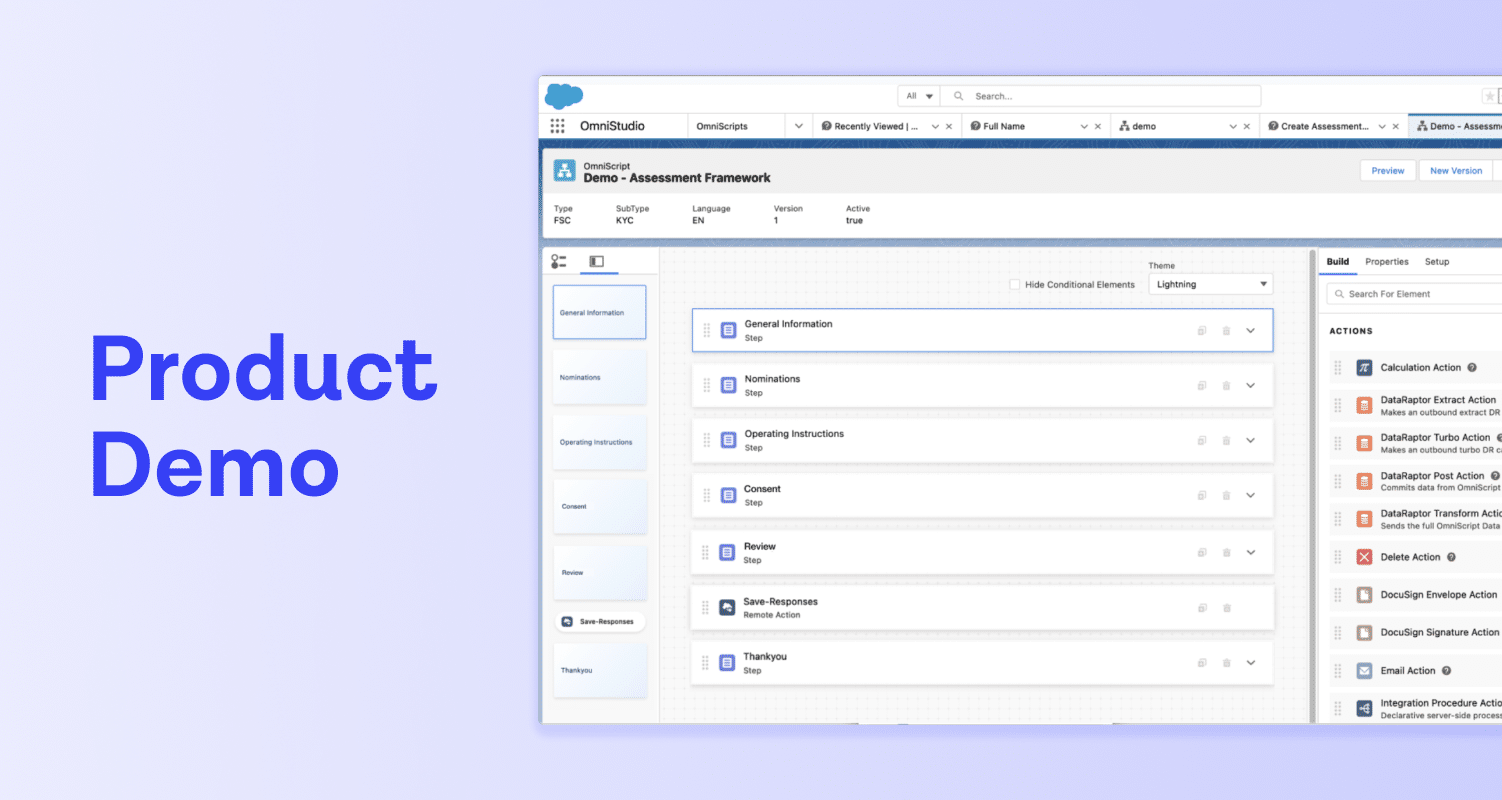

Prevention and detection: How do you prevent things like account takeovers? How do you protect against fake or stolen identities and data? And how do you do all this without deterring real, genuine customers? Using an identity verification solution to anchor your users’ digital identities to their real identities can help address these issues.

-

Technology and analytics: Digital banking and other financial services are increasing. Humans alone can no longer keep up with the scale and magnitude of fraud. To combat the risks associated with this, banks need to employ smarter technology and analytics to detect, deter and prevent fraud.