Onboarding for digital banks

Scale your growth without introducing fraud and compliance risk. The Real Identity Platform is an end-to-end identity verification platform that enables frictionless onboarding, regulatory compliance, and fraud detection.

High growth shouldn’t mean high risk

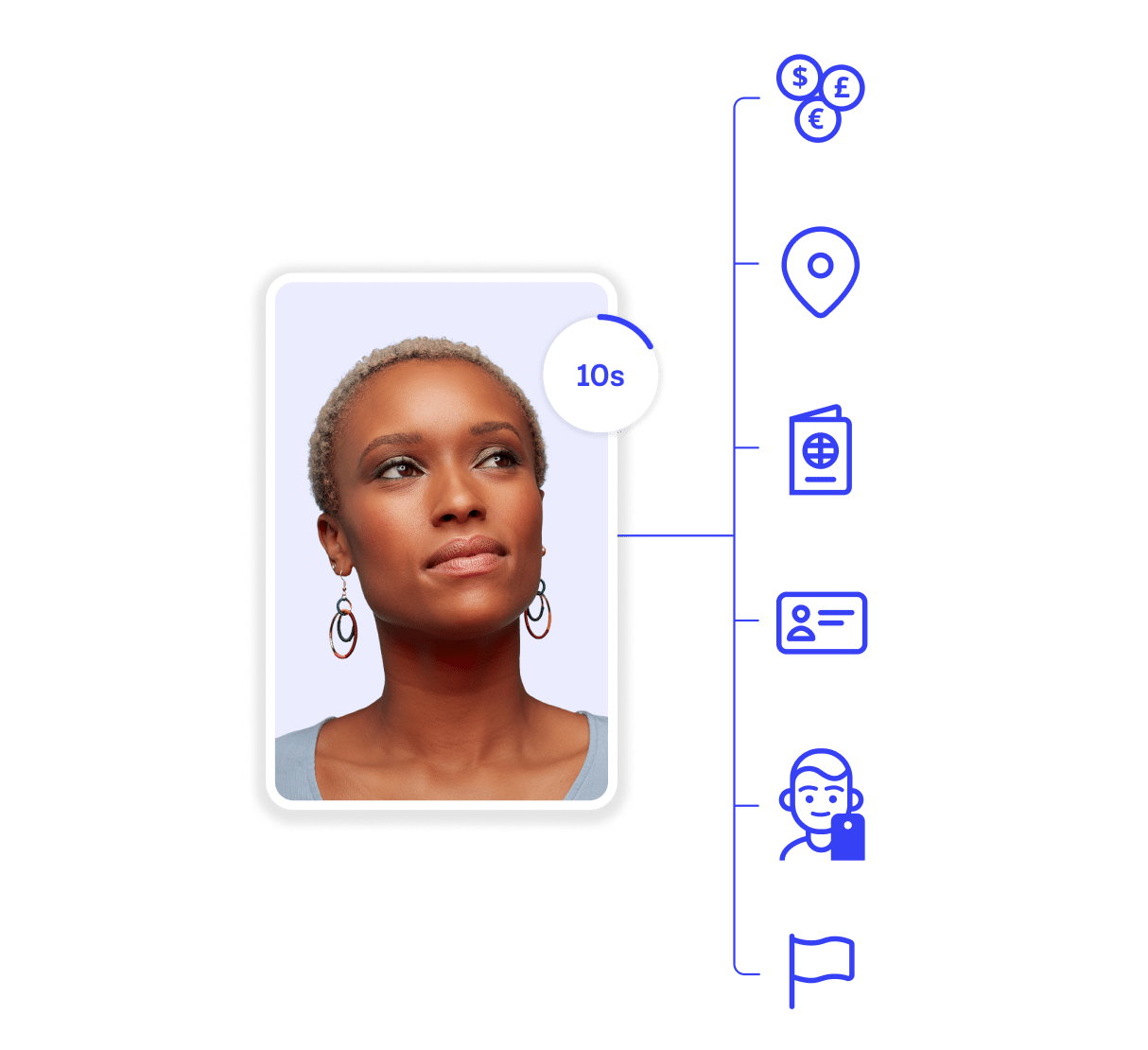

It’s tough to keep a user-experience edge in banking. Digital transformation has swept the industry — which means best-in-class digital experiences are table stakes, especially at onboarding. But at the same time, KYC and compliance are non-negotiable, and identity fraud is getting smarter. You need a scalable way to know your customer in seconds, without relying on manual processes.

Secure your growth with automated KYC

Scale compliance programs

Meet a range of regulatory requirements in a single automated platform.

UX excellence

Maximize onboarding conversion with intuitive identity verification.

Stop advanced fraud

Prevent fraudulent onboarding with a multi-layered approach to identity.

Create efficient processes

Optimize your onboarding processes with AI-powered automation.

How can Onfido help?

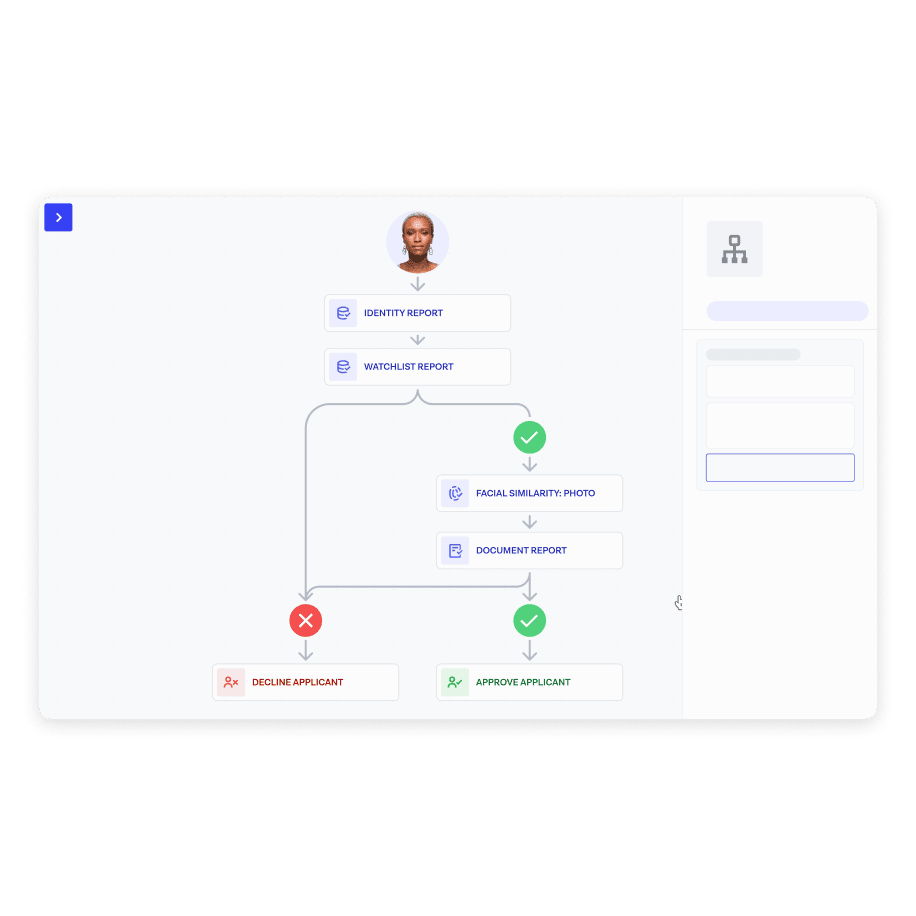

Onfido Studio

Orchestrate identity verification workflows in a no-code interface. Build, measure, and deploy journeys matched to the unique requirements of your bank — combining a mix of document and biometric verification, trusted data sources, and passive fraud detection signals.

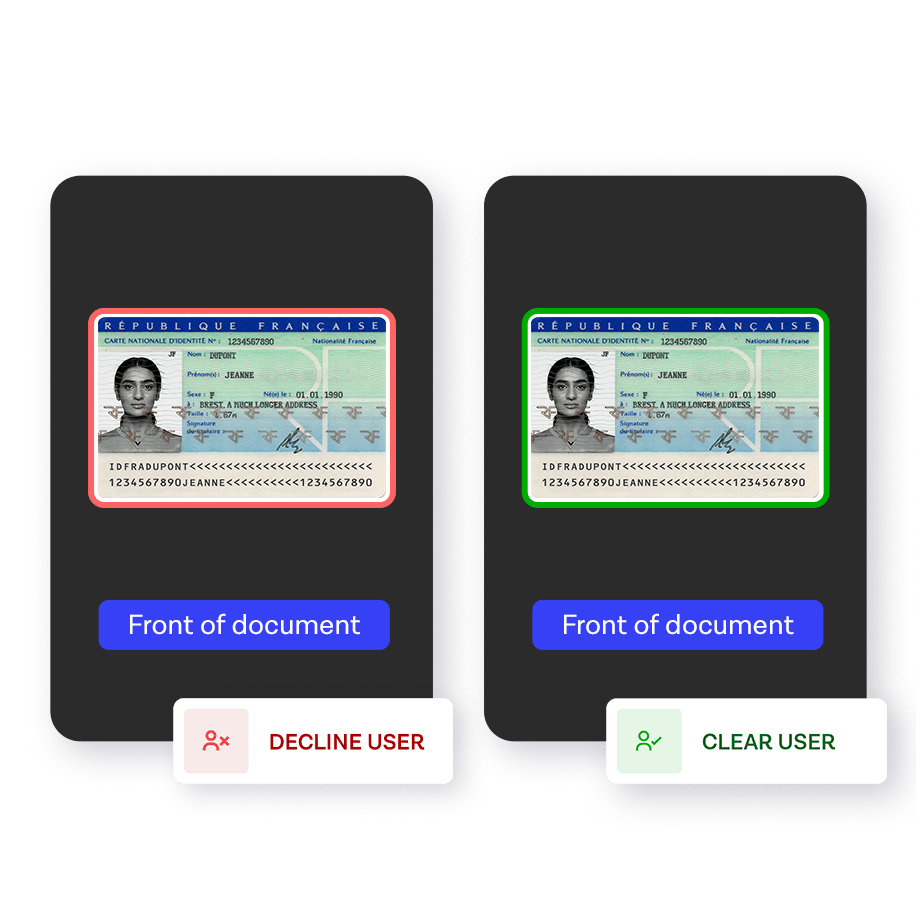

Document Verification

Have confidence in your customer’s identity by verifying a photo ID. Powered by Atlas™ AI, our Onfido document verification is fair, accurate, and delivers results in seconds.

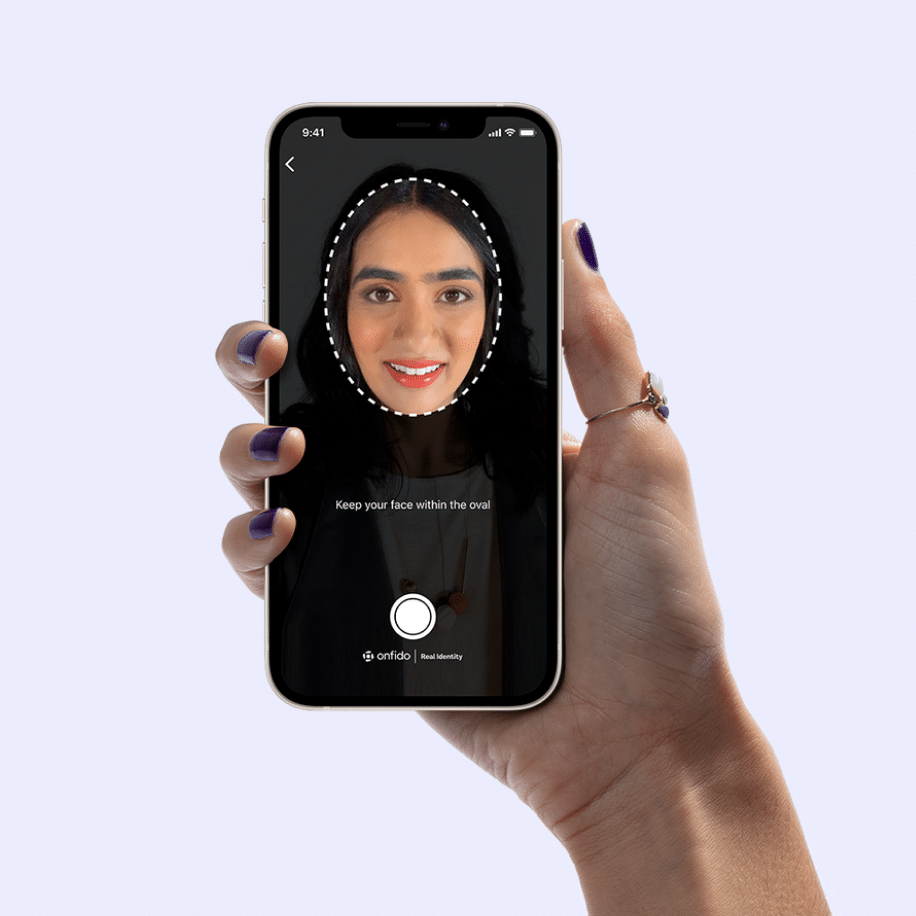

Biometric Verification

Build on document verification by connecting that ID to a real person. Onfido Motion adds another fully automated layer of fraud protection, with a seamless UX.

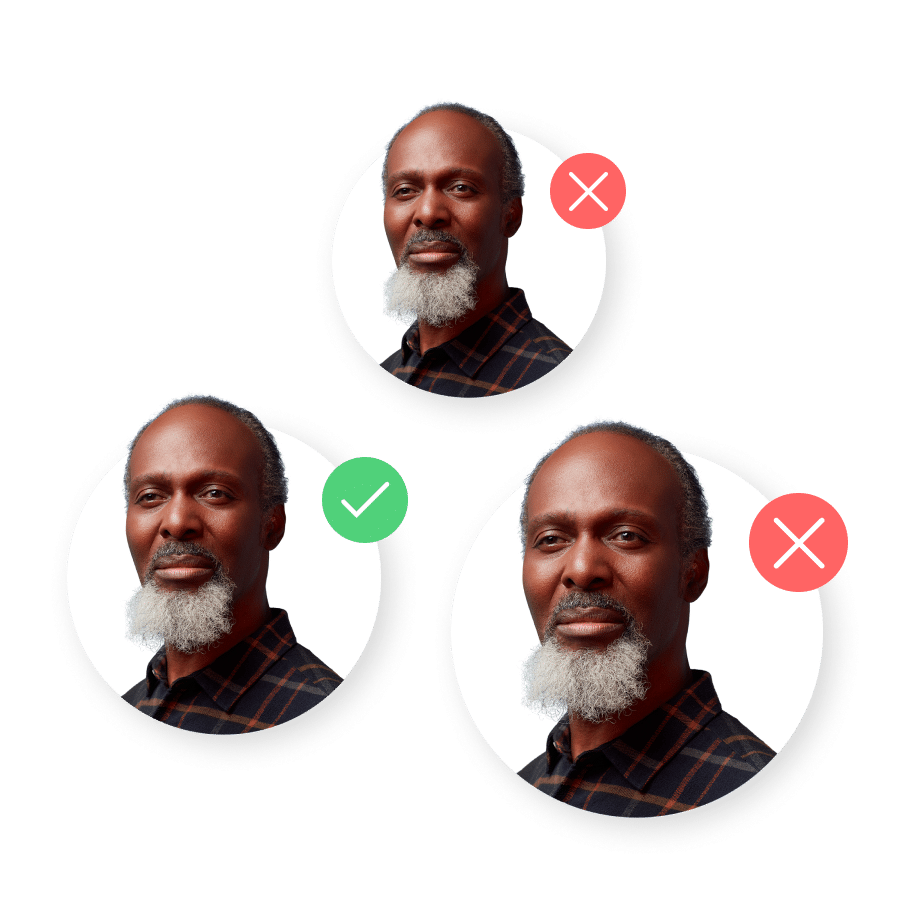

Known Faces

Check if the same face has already been used to create an account — with no additional friction. Known Faces checks for repeat faces within the past year — identifying bad actors trying to fraudulently create an account as well as users trying to create multiple accounts.

Repeat Attempts

Confidently catch sophisticated document fraud with a real-time comparison to historic onboarded documents to detect repeat ID document usage. Repeat Attempts operates in the background and requires no additional action from your users — strengthening security without adding friction.

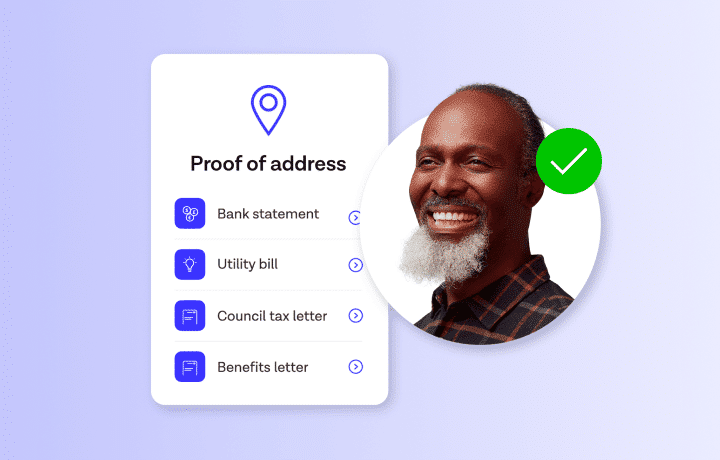

Proof of Address

Verify a user’s address to meet KYC onboarding requirements. Onfido’s automated Proof of Address verification makes it easy for your customers to submit a document during the sign up workflow.

Watchlist

Validate applicant data against sanctions, PEPs and adverse media to meet KYC and AML requirements.

Smart Capture SDKs

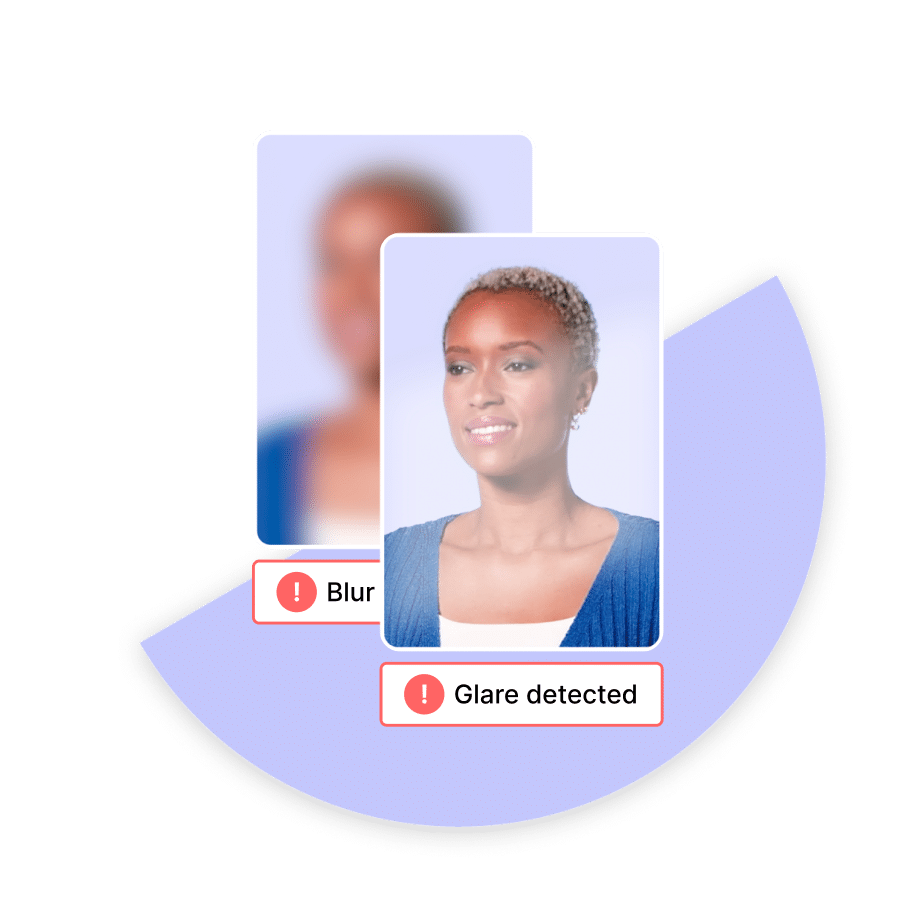

Integrate best-in-class capture experiences on mobile and desktop. Our Smart Capture SDKs are built with user experience and security in mind with features like real-time blur and glare detection, multi-frame image capture, and WCAG AA accessibility features.