Cryptocurrency has gone mainstream. Although still primarily used for investment purposes rather than outright commerce, it has never been more accessible. In 2021 transaction volumes hit $15.8 trillion, up 567% from 2020. As the market matures, financial regulators and lawmakers are eyeing up whether existing laws and regulations are suitable for technology that was (by and large) inconceivable when it was written. Keep reading to learn how regulation is developing, and what we expect to see in the coming years. Before we dive into KYC meaning in crypto, we need to address the philosophy ingrained in cryptocurrency.

Why is cryptocurrency anonymous?

Anonymity is central to the philosophy that birthed Bitcoin. The inventor of the first cryptocurrency was identified only by a pseudonym — Satoshi Nakamoto. In October 2008 they published the now infamous Bitcoin whitepaper that introduced the concept of a decentralized electronic currency to the world. Three months later they released version 0.1 of the Bitcoin software and reference material needed to deploy the first blockchain database along with a short essay that stated: ‘The root problem with conventional currencies is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust.’

Bitcoin and the blockchain were born of mistrust of traditional financial systems, and more than a decade later, anonymity is still largely ingrained. Transactions are recorded on decentralized ledgers called blockchains. So users can transfer cryptocurrency between wallets without using bank accounts housed in traditional financial systems — so KYC in crypto has historically automatically been sidestepped.

What are policymakers doing to strengthen crypto KYC?

In the United States, cryptocurrency is on the radar for Congress, the White House and federal agencies. On March 9, 2022, President Biden signed an executive order (EO) calling for the U.S. to take the lead on cryptocurrency regulation. According to the EO, ‘we must take strong steps to reduce the risks that digital assets could pose to consumers, investors, and business protections; financial stability and financial system integrity; combating and preventing crime and illicit finance; national security; the ability to exercise human rights; financial inclusion and equity; and climate change and pollution.’ The EO specifically directs U.S. government agencies to take steps to mitigate security risks. It also instructs agencies, including the Department of the Treasury, Department of Homeland Security, Department of State, and the Federal Reserve to research and report on creating a Central Bank Digital Currency — essentially a stablecoin, that would likely track the value of the dollar. Following the EO, Senators and Members of Congress from both sides of the aisle highlighted their interest in working on the cryptocurrency legislation — which will likely target KYC crypto processes.

While the timing of next steps is unclear, one thing is certain — cryptocurrency and crypto KYC processes will be a focus for policymakers for some time. The Executive Branch will use its existing authority to make changes in the regulatory environment, however any legislative changes will require Congressional action. While many Members of Congress are starting to learn about cryptocurrency, others are actively working on legislation that if enacted will require additional regulation. Recently, Federal Reserve Chairman Jerome Powell highlighted the need for policymakers to take action: ‘Our existing regulatory frameworks were not built with a digital world in mind. Stablecoins, central bank digital currencies, and digital finance more generally, will require changes to existing laws and regulation or even entirely new rules and frameworks.’ When determining next steps, we can expect policymakers to focus on three priorities — protecting consumers (including ensuring financial inclusion), ensuring financial stability and financial system integrity, and preventing crime and illicit finance.

Learn more in this article from our Director of Policy, Matt Peake. It dives into what's expected, and why changes are coming.

What are the arguments for crypto KYC processes?

There are many positive uses of cryptocurrency. Ukraine received over $100m of bitcoin donations in three weeks, at a time when the traditional banking infrastructure was disrupted. It has also allowed people experiencing hyperinflation to stabilize their assets in Turkey and Lebanon. But, cryptocurrency has long been associated with illicit activity, fraud and money laundering. The baked-in anonymity makes it attractive for exactly the reason you’d expect — no one knows who you are on the blockchain. It's true there is a permanent record of fraudulent transactions between wallets. But unless the transaction was completed on an exchange conducting know your customer (KYC) processes, the wallet owners remain anonymous.

In 2021, $14 billion was lost to crypto fraud, nearly double what was lost in 2020. One prominent application has been gangs receiving payment for ransomware attacks, where organized cyber criminals remotely encrypt a victim’s computer, then offer the keys in exchange for payment. Another growing application is large-scale money laundering — which grew 30% from 2020 to 2021. It could be argued these failures of the currency could be limited if KYC verification in crypto was adopted more widely.

Is cryptocurrency really anonymous?

Anonymity isn’t absolute. For most cryptocurrencies, whenever a transaction is made it’s permanently visible on the blockchain — meaning transactions are trackable and mappable. Some businesses specialize in doing this, mapping the number and volume of transactions to understand which wallets are being used for illicit activity. What is anonymous by default is ownership of the wallets at either end of the transaction. Most of the time anyway.

What does KYC mean in crypto?

The Financial Action Task Force (FATF) recommends a risk-based approach for exchanges, similar to what it recommends for traditional financial services. The first step of this approach is to conduct KYC crypto processes — getting names, addresses, dates of birth. In 2019 a joint statement from the U.S. Securities and Exchange Commission (SEC), Financial Crimes Enforcement Network (FinCEN), and CFTC (Commodity Futures Trading Commission) clarified crypto exchanges are money service businesses (MSBs) — which means they are subject to KYC and anti-money laundering (AML) rules under the Bank Secrecy Act of 1970.

However, only exchanges that convert fiat to crypto or crypto to fiat are guaranteed to conduct KYC/AML checks. Because these exchanges have to deal with the traditional financial system to take place, the system won’t work with them otherwise due to regulatory requirements.

Other exchanges have fallen into somewhat of a gray area — the question being, are they subject to regulation written for the traditional banking system? As such, many centralized and P2P exchanges have voluntarily chosen to collect KYC info to get ahead of the regulatory curve, enable expansion and even create positive friction in order to cultivate reputations as being trustworthy exchanges.

It seems mainstream users are not deterred by undertaking KYC when opening an account. Changpeng Zhao (Binance, CEO) stated "we have chosen to go with full compliance, full mandatory crypto KYC for global users, for every feature. We feel that being compliant will allow more users to use us. Most people do feel more comfortable using a licensed exchange. Most people — 97% of users — go through KYC. We lose only three percent of users."

How can Onfido help with crypto KYC?

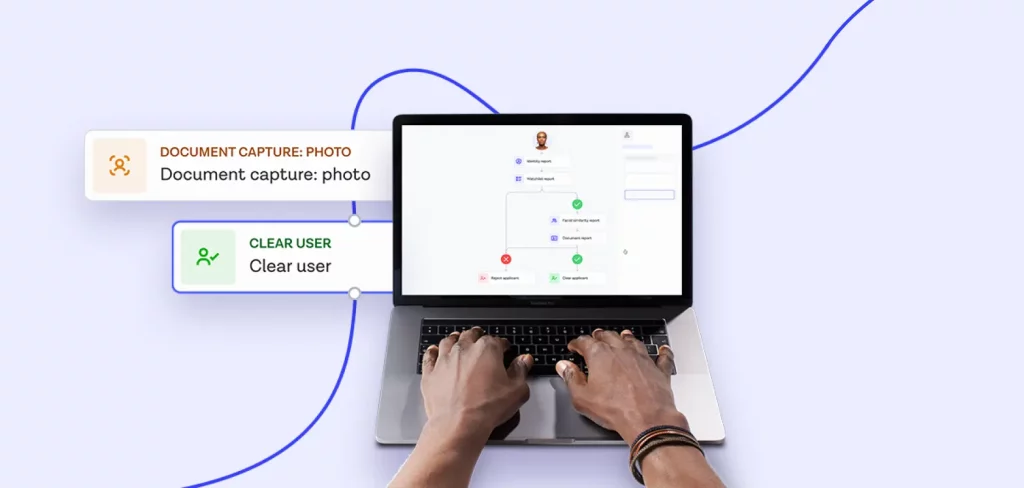

Onfido provides a range of identity solutions ranging from data verification via ID record checks, sanctions screening, PEP screening, adverse media screening and ongoing monitoring. We also offer market-leading document and biometric verification grounding users to their real identity by analyzing a photo ID and a selfie anytime, anywhere. We work with some of the world’s largest financial services companies as well as the world’s most established crypto exchanges like Luno, CoinDCX, BitPay, and Phemex to conduct identity verification as part of their commitment to KYC and AML requirements.

To learn more about how Onfido can help crypto exchanges navigate KYC and AML requirements, check out our interactive tour of the Real Identity Platform — it runs through our Verification Suite, and walks through how to access a free trial.