Turning back the clock five years, we set out for the first time to analyze a year’s worth of fraud data and answer questions like:

- Which documents do fraudsters target most?

- Which techniques do fraudsters favor?

- Can we identify any patterns in fraudulent behavior?

The goal was to provide an in-depth overview of the types of fraud that impact the identity verification space, to share our learnings, and help businesses protect themselves.

Five years later, we continue to build on that analysis with the release of our fifth annual Identity Fraud Report.

What has five years of making the Fraud Report taught us? It’s given us a unique perspective into how the fraud landscape has changed, where we think it’s headed, and helped to identify fraud patterns and trends that span geographies, sectors, and business profiles.

Fraud, the big picture

Fraud is a global issue. It can affect anyone, anytime, anywhere. And it costs big, as proven by the stats.

- 71 million people fall victim to cybercrimes globally every year.

- 20% of Europeans have been victims of identity fraud in the last two years, based on European Commission research.

- 1 in 3 Americans has been a victim of identity fraud.

- Fraud costs the global economy roughly 6 trillion dollars in damages every year.

Data analysis: how we identify fraud trends

Our analysis at Onfido focuses on the fraud we see during the identity verification process. In other words, how do fraudsters target businesses during onboarding? What techniques do they use to attempt to circumvent KYC and other identity-proofing checks?

Identity verification typically involves two steps: document verification to establish credentials and check that an ID is genuine, followed by biometric verification to ensure a real person is present, and the face matches the ID presented. A lot of the insight we’ve gathered about fraud trends over the years therefore relates specifically to document fraud or biometric fraud.

We see millions of verifications come through our system, which gives us a unique insight into document and biometric fraud. We focus our analysis on things like:

- What percentage of our overall document and biometric checks are suspected cases of fraud

- What techniques do fraudsters use when they attack documents (for example counterfeits versus forgeries, physical versus digital methods)

- Which documents (and document types) are more frequently defrauded

- What techniques do fraudsters use when trying to spoof biometrics

- When we see the highest volume of fraudulent attempts, including time of day, day of the week, or any spikes over a year

- What types of fraudulent attempts do businesses based in different regions experience

Fraud trends: what’s changed in five years?

Our Identity Fraud Report 2024 mostly focuses on data from the previous year. However, we also compare that data to our previous years' worth of data, to help identify any long-standing trends, and see what’s changed.

So what can we learn from five years of fraud analysis?

Let’s cast our minds back to 2019. The world looked a little different. Many businesses were starting to use digital identity verification for the first time, AI tools were less widely available to the everyday user, and on the whole, people worked from an office five days a week.

Fast forward to today, global businesses have widely adopted digital identity verification, generative AI tools have exploded, we’ve lived through a global pandemic, and work-life has shifted predominantly to remote-first.

These changes over the last five years mean fraudsters have also adapted how and when they operate.

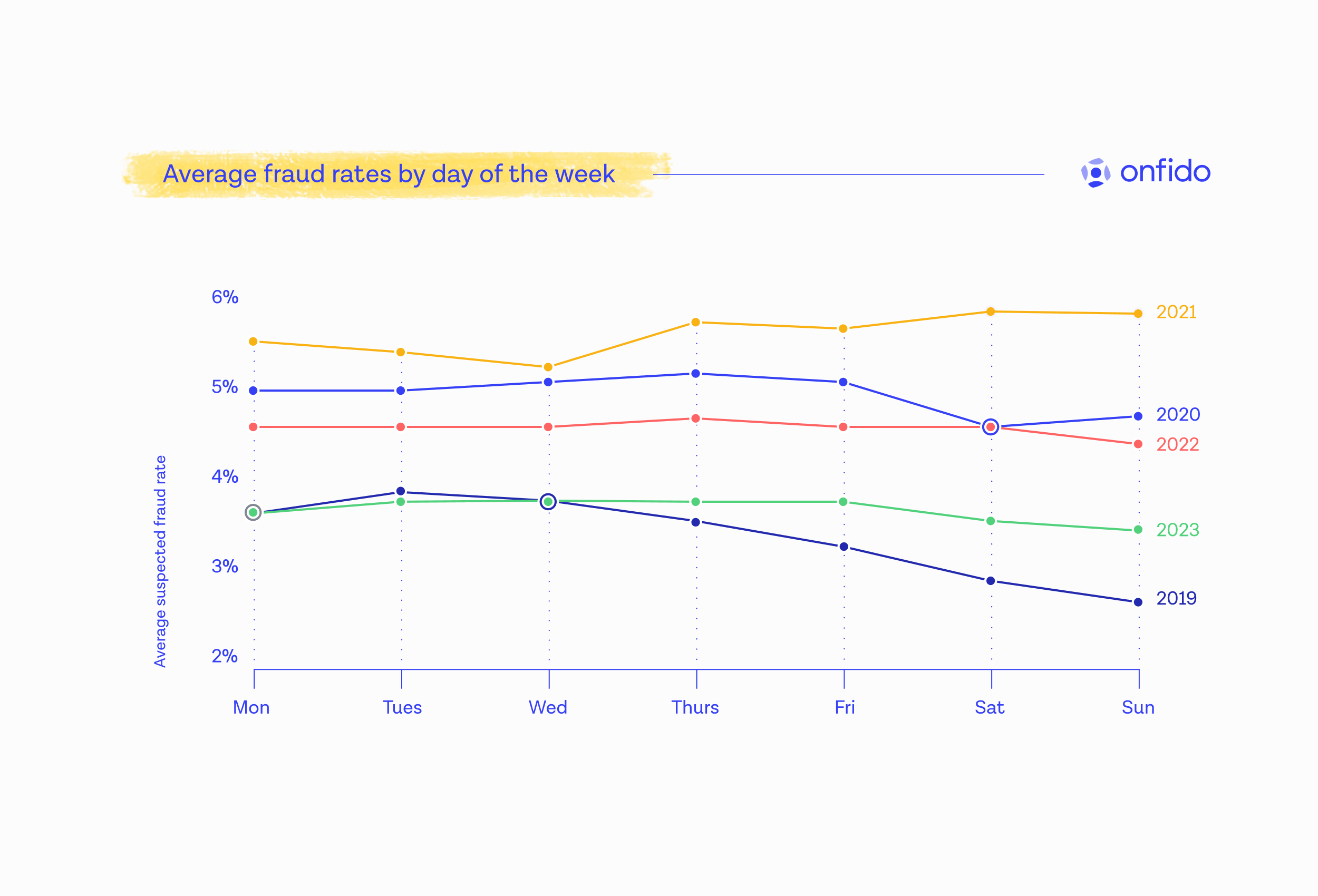

9-5 is dead, 24/7 is the new norm

Back in 2019, fraudster activity mirrored an average working week. We saw higher levels of fraud Monday to Friday and lower levels at weekends. That all changed when we experienced a global pandemic. Peak pandemic, fraudulent activity spiked at weekends, suggesting fraud became more of a recreational add-on rather than a dedicated 9-5.

Post-pandemic, fraud levels are fairly consistent seven days a week. Just as we’ve moved to a remote-first professional working culture that allows us 24/7 access, fraudsters have done the same.

From physical to digital document manipulation

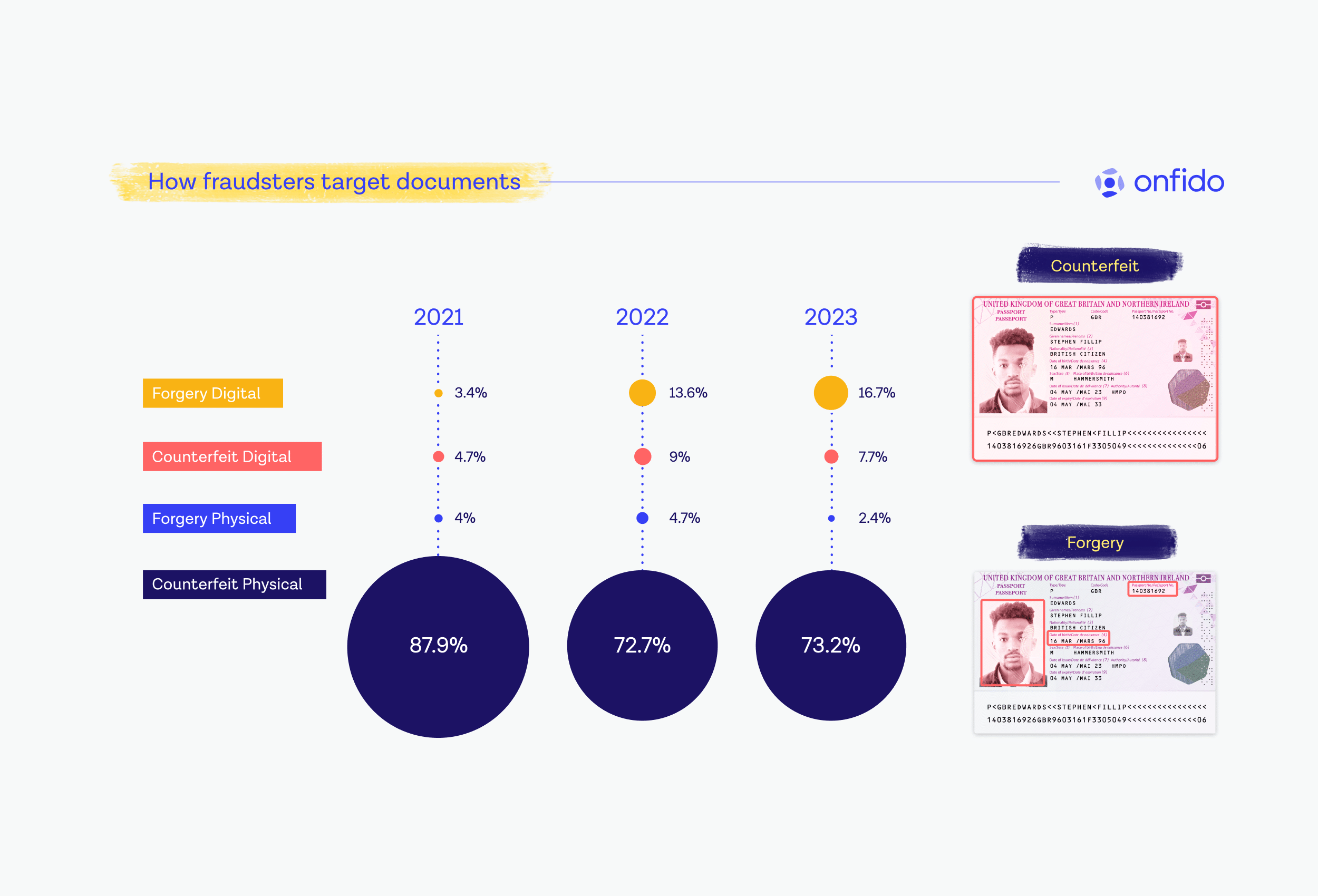

Fraudsters have four ways to attack identity documents. They can:

- Reproduce a real document (physical counterfeit)

- Edit an existing document (physical forgery)

- Create a digital representation of a document (digital counterfeit)

- Edit an existing digital image/template of a document (digital forgery)

We have always seen far more physical counterfeits than any other fraud type. But this is changing. Over the last few years, there has been a rise in digital forgeries, most likely due to the availability of photo editing software. As digital forgeries are quicker and cheaper to produce, it’s likely we’ll see more of them in the next few years.

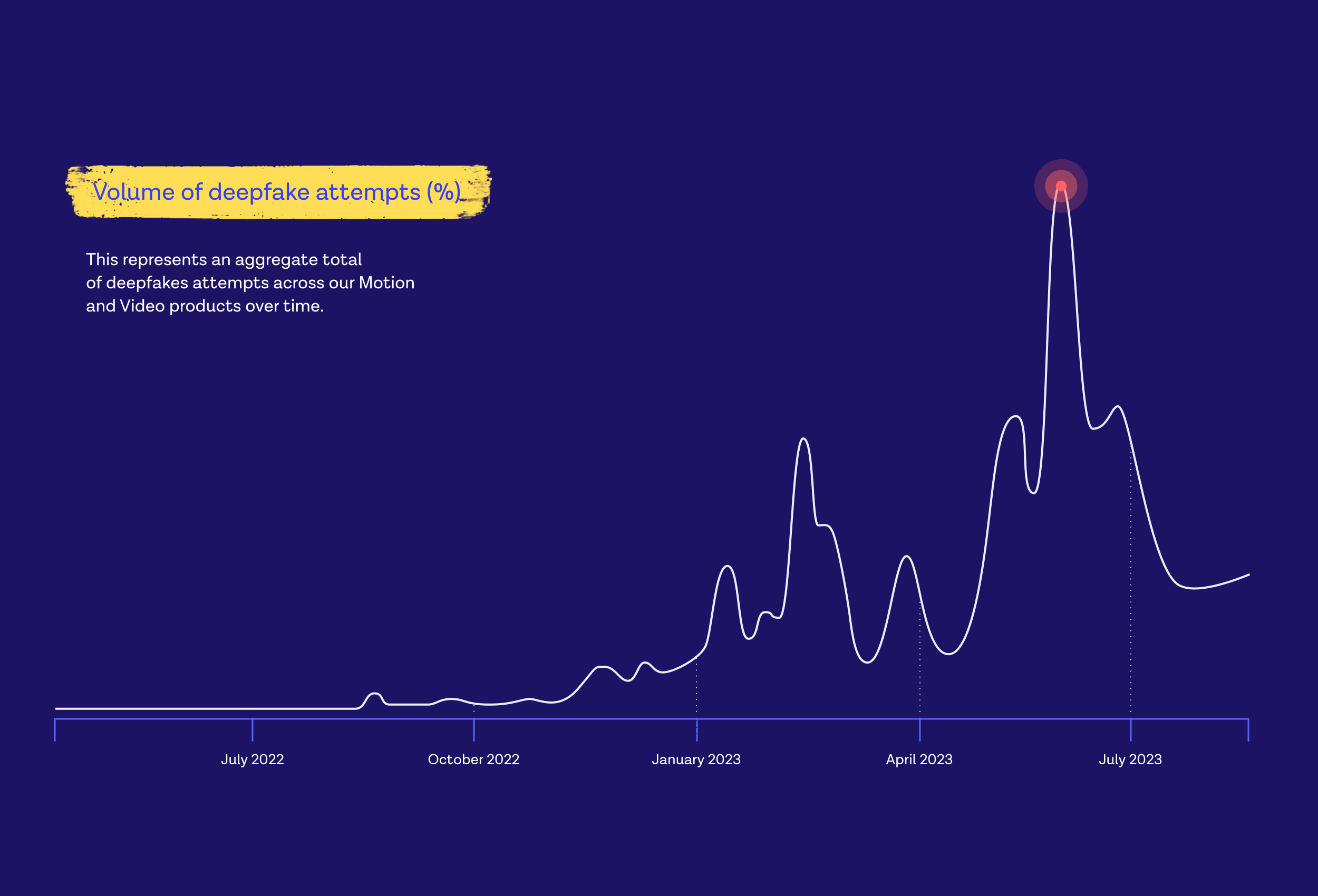

Deepfakes: the biometric threat of today

Biometrics remain one of the best fraud deterrents out there. However, ease of access to generative AI and face-swapping apps has created a new way in for fraudsters. A few years ago we’d see crude attempts at spoofing a biometric check (such as 2D masks). The number of deepfakes we’d see? Virtually zero. Until recently, deepfakes were rare because of the sophistication and difficulty of producing them.

But 2023 is the year of deepfakes. We’ve seen a huge increase in the number of deepfakes attacks in 2023 compared to 2022. Generative AI is changing the game across the board. It’s likely to play a bigger role in the types of fraud threats we see going forwards, as fraudsters turn to more digital forms of manipulation.

Read up on some of the measures businesses can implement to prevent deepfakes in our report.

Or hear how to stay ahead of sophisticated fraud, direct from the experts, in our on-demand webinar Fraud Predictions for 2024.

Fraud prevention: a feat of collaboration

Our annual Identity Fraud Report is a masterclass in collaboration. The work crosses teams, with input from Onfido’s fraud experts, product analysts, data scientists, research teams, writers, and designers.

Just like the work that goes into our Fraud Report, fraud prevention in itself is a task no one can succeed at alone. We hope that by sharing our analysis, we can arm more businesses with some of the insights they need to help prevent fraud at onboarding.

Discover how Onfido can help protect your business from fraud. Prevent money laundering attempts, synthetic fraud, deepfakes, and account takeover.